2025-09-11

2025-09-11

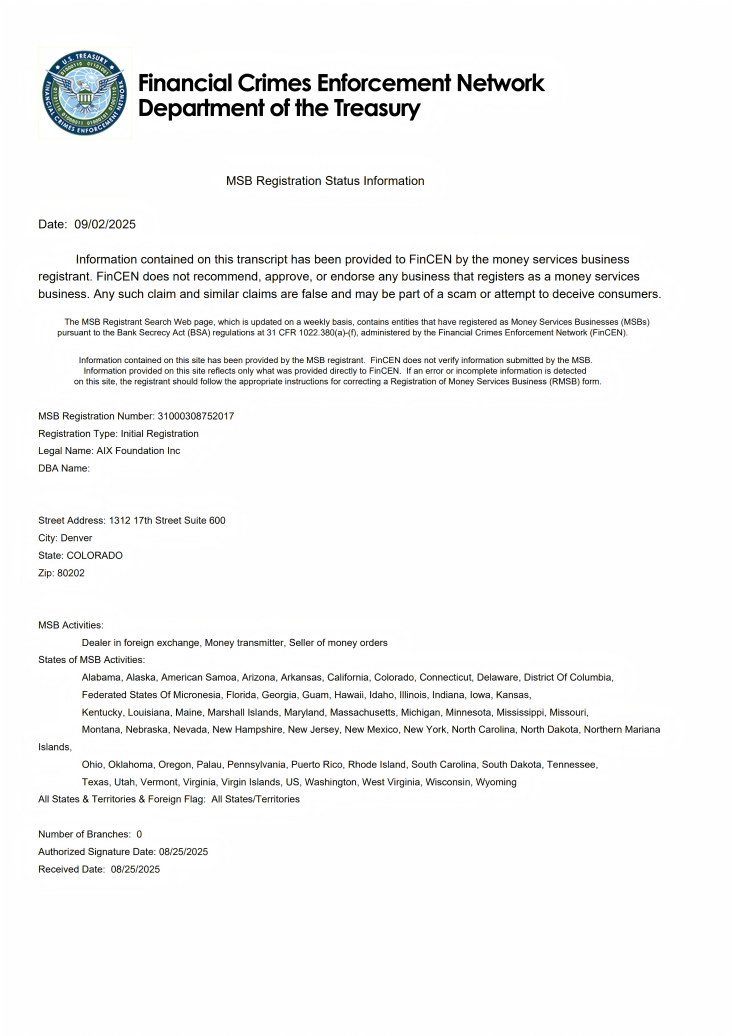

In September 2025, AIX Foundation Inc. announced that it has successfully obtained the MSB (Money Services Business) license issued by the Financial Crimes Enforcement Network (FinCEN) under the U.S. Department of the Treasury. This achievement marks a significant milestone in AIX’s compliance and professionalism within the global financial services market, providing greater security and reliability for users worldwide. Well-known platforms such as Coinbase and Binance also hold MSB licenses. Securing this license will help AIX earn the trust of global investors through regulatory compliance and effectively execute its global operations strategy. At the same time, AIR1, the first RWA (Real World Asset) digital asset in the AIX ecosystem, will accelerate its adoption across governance, settlement, and incentive scenarios under this compliance framework.

The MSB license covers all 50 U.S. states and territories, authorizing Decode Digital Markets USA Inc. to provide a wide range of financial services, including check cashing (including traveler’s checks and money orders), digital asset trading, foreign exchange dealing, money order issuance, traveler’s check issuance, money transmission, money order sales, prepaid access card sales, and traveler’s check sales. This license greatly enhances the legality and operational scope of AIX Foundation Inc.’s activities in both the U.S. and global markets.

MSB Registration Number: 31000308752017

Registration Type: Initial Registration

Legal Name: AIX Foundation Inc.

(The license details can be verified directly on the MSB official website by entering the registration number 31000308752017.)

AIX’s successful approval demonstrates its high standards in platform structure, governance mechanisms, financial security, and global compliance. It also highlights AIX’s innovative achievements in DAO governance, on-chain asset transparency, and user rights protection.

With the U.S. MSB license secured, AIX is poised to accelerate node deployment, trading facilitation, and ecosystem collaboration in the global market, providing compliant and verifiable entry points to digital computing power assets for both U.S. and global investors. AIX will continue to strengthen its full-chain compliance framework of “compliant issuance — compliant use — compliant circulation”:

① Compliant Issuance & Governance: Advance the transparent issuance and governance of AIR1 under a regulatory framework, continuously strengthen community proposal and voting mechanisms, and ensure all key rules are recorded on-chain and verifiable.

② Compliant Settlement & Trading: Leverage smart contracts to automate and audit clearing, settlement, trading, and incentive distribution, minimizing counterparty risks.

③ Compliant Risk Control & Transparency: Continuously upgrade KYC/AML systems and on-chain risk models, supported by third-party audits and open-source disclosures, ensuring clear and traceable asset flows.

As the core token of the AIX ecosystem, AIR1 assumes three fundamental roles:

1. Governance & Consensus: Grants the community proposal and voting rights to drive decentralized decision-making on key parameters and resource allocation.

2. Settlement & Incentives: Powers trading, fees, and settlement, linking miners, nodes, and users through a wide range of incentive mechanisms.

3. Ecosystem Expansion: Serves as a value intermediary within the partner network, enabling applications such as computing power leasing, staking, mining, and liquidity support.

AIX stated that in the context of increasingly mature global digital financial regulations, compliance has become the fundamental threshold for the sustainable development of crypto assets and Web3 projects. AIX is actively aligning with global regulatory frameworks and is advancing multi-jurisdictional licenses, including Canada’s MSB, Singapore financial institution registration, and Hong Kong’s Virtual Asset Service Provider (VASP) license.

Looking ahead, AIX will further strengthen its strategic roadmap of “global nodes + multi-chain deployment + compliant services + RWA ecosystem co-construction.” With AIR1 and additional RWA digital assets as its value core, AIX aims to continuously empower Web3 infrastructure development and drive the deep integration and commercialization of computing power assets in emerging sectors such as AI, DeFi, NFTs, and digital financial payments.