2024-10-10

2024-10-10

Vents magazine

Vents magazine

The globally leading digital asset trading platform Managed Global Securities Trade Ltd. (hereinafter referred to as MGST) has recently announced that the company has been planning for several months and has gradually submitted its application for an initial public offering (IPO). It is expected to list on the New York Stock Exchange (NYSE) in the coming weeks, with the stock ticker yet to be announced. This IPO is anticipated to have a valuation of $7 billion, marking a significant step for the company to further expand into global markets, drive technological innovation, and strengthen its leadership position in the digital asset trading sector.

Backed by top-tier venture capitalists with $1.5 billion in subscribed shares.

MGST's IPO plan has received strong support from several top venture capital firms, including Sequoia Capital, Lightspeed Venture Partners, and Tiger Global Management. These firms have collectively subscribed to $1.5 billion in shares, demonstrating their high confidence in MGST's long-term growth potential in the digital asset sector.

CEO Philip J. Hermann stated, "The support from top venture capital firms is a tremendous recognition of our business model and market prospects, providing a solid financial foundation for our further global expansion and technological innovation."

Strong financial stability with robust growth momentum.

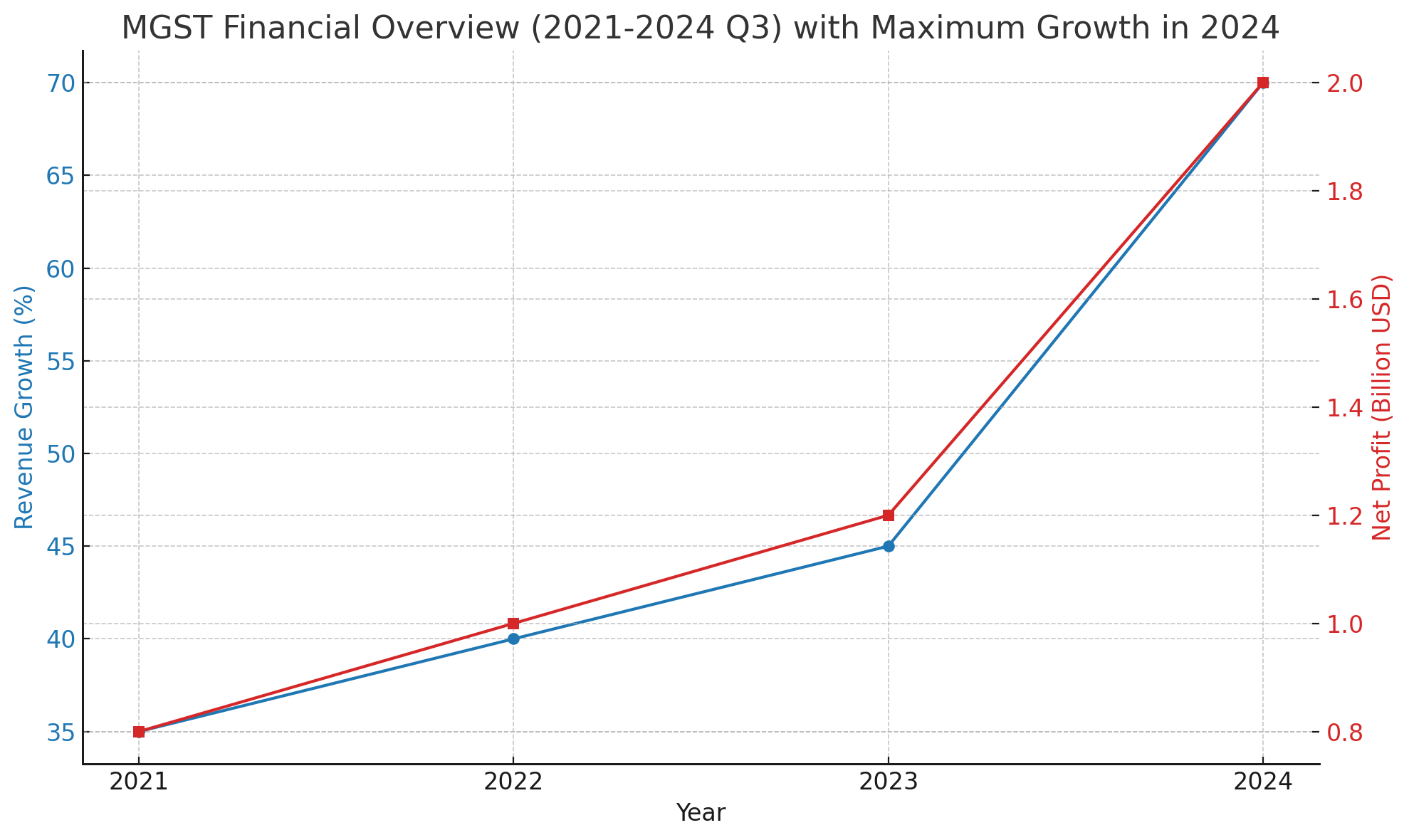

According to MGST's latest financial report, the company's revenue in the third quarter of 2023 increased by 45% year-on-year, with a net profit of $120 million. However, in the third quarter of 2024, the company achieved even greater growth, with revenue surging by 70% and net profit reaching $200 million, setting a new historical high. MGST's user base also rapidly expanded in 2024, with active users increasing from 300,000 in 2023 to 450,000, reflecting strong market demand and a broad customer base.

As shown in the chart, the revenue growth rate has steadily increased, with net profit rising from $80 million in 2021 to $200 million in 2024. Meanwhile, the number of active users has also shown significant growth, reaching 450,000 in 2024.

Hermann emphasized, "This IPO is a significant milestone in the company's development. With the funds raised, we will accelerate our pace of technological innovation, continue to lead innovation in the digital asset trading market, and expand our market share globally."

Financial compliance and transparency ensure a safe and secure path.

MGST's core advantage lies in its ongoing technological innovation capabilities. The company actively utilizes big data, artificial intelligence, and blockchain technology to optimize user experience and enhance platform operational efficiency. Recently, MGST has entered into partnerships with several leading blockchain technology firms in the U.S. and Europe to improve platform security and promote the application of decentralized finance (DeFi).

Hermann stated that the funds raised from the IPO will be used to enhance the company's technological research and development, as well as to expand into global markets, particularly in emerging markets in the Asia-Pacific region and South America. "We see immense potential in these emerging markets and plan to accelerate market penetration through mergers and acquisitions, further solidifying MGST's global influence."

NBC NEWS interview clip

https://gangpic.oss-ap-southeast-1.aliyuncs.com/mga-fweihwoqf333.mp4

Financial compliance and transparency safeguard the way forward.

As a company headquartered in Colorado, USA, MGST has long adhered to global financial and regulatory compliance requirements, obtaining approvals from regulatory agencies in multiple countries. MGST ensures that its operations in various global markets comply with local laws and regulations, maintaining financial transparency at all times.

Hermann emphasized, "Compliance and transparency are the cornerstones of our business, ensuring that every transaction meets the regulatory requirements of the global market. This is also one of the key reasons we have earned the trust of global investors."

Looking ahead, MGST plans to increase its investment in research and development in the blockchain and decentralized finance (DeFi) sectors, enhancing the efficiency and security of its trading platform. The company also aims to further drive the development of the global digital asset market through global market expansion and technological innovation.